Intelligent Segmentation

The Heart of Credit Scoring & Predictive Analytics

Your engine for transparent, strategic intelligence and resource optimization.

Built for clarity. Powered by binning. Trusted in credit scoring and risk modelling.

Managed by our team • Reliable service, no setup needed

Intelligent Segmentation.

Transforming Raw Data into Actionable Insights.

Your engine for transparent, strategic intelligence and resource optimization. Built for clarity. Powered by segmentation.

Our Case Studies

Real-world applications of intelligent customer segmentation analysis

The Engagement Paradox: When Usage Misleads and Segmentation Tells the Truth

Most companies track customer metrics—such as usage frequency, tenure, and support interactions—but few truly understand what these numbers reveal about their business health. Traditional correlation analysis might indicate that "higher usage correlates with lower churn", but it does not reveal where the critical thresholds lie, which segments are losing revenue, or why even the most engaged customers still leave.

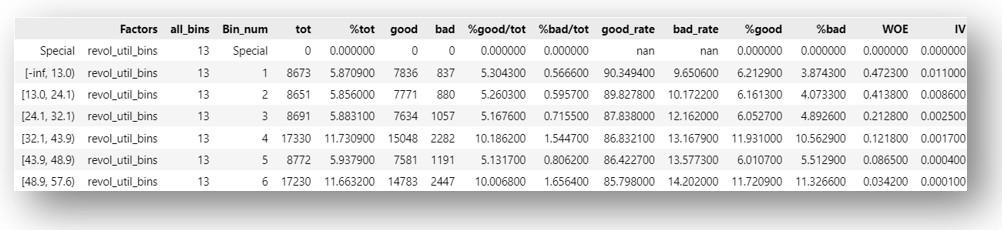

This is where Smart Segmentation (binning) analysis with Weight of Evidence (WOE), Information Value (IV), KS statistics, and Gini coefficients transforms raw data into strategic intelligence. By segmenting continuous variables into discrete bins, we can uncover non-linear relationships, identify crucial tipping points, and measure the true predictive power of each feature.

Here is what makes this approach revolutionary:

Information Value (IV) quantifies how strongly a feature predicts churn (0.02–0.1 = weak, 0.1–0.3 = moderate, 0.3+ = strong).

Weight of Evidence (WOE) reveals whether this bin increases or decreases churn probability.

KS Statistic identifies the maximum separation point between churners and non-churners.

Gini Coefficient measures the overall discriminatory power (ability to separate churners and non-churners) and the direction of the relationship.

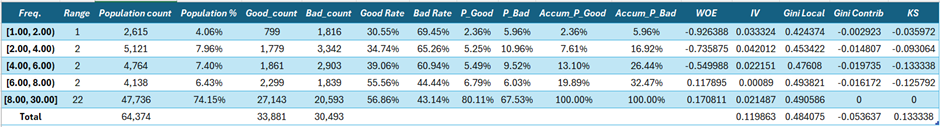

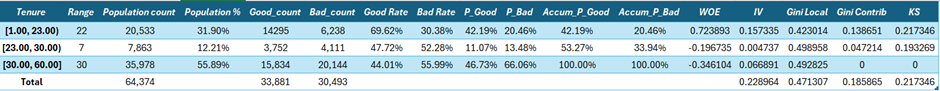

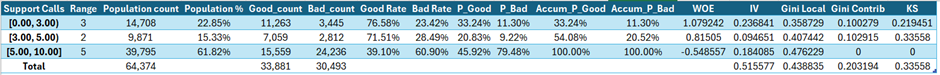

Instead of simply knowing that "usage matters," we discover that customers with 8–30 uses still churn at 43%, meaning high activity does not guarantee retention. Instead of believing that "tenure builds loyalty", we find that customers at 30+ months churn at 56%—worse than new customers—indicating a value decay challenge. Instead of assuming "support shows engagement," we learn that 62% of customers make 5–10 support calls and 61% of them churn, exposing a fundamental product usability problem.

In the following three analyses, we examine:

Usage Frequency (IV: 0.120) — Why your power users are still leaving

Tenure (IV: 0.229) — Why time works against you, not for you

Support Calls (IV: 0.516) — Your strongest predictor and biggest crisis

Each analysis goes beyond the numbers to reveal root causes, competitive vulnerabilities, and actionable strategies. This is not just data analysis—it is a diagnostic of fundamental business model problems hiding in plain sight.

Takeaways:

The main cause of churn is a complex product that most customers find difficult to use.

Support Calls show frustration is driving churn, not engagement.

Longer tenure increases churn — customers lose patience over time.

High usage doesn't mean satisfaction — people are active but unsuccessful.

Only 23% of customers thrive; 77% struggle and eventually leave.

This is a product-market fit problem, not a customer success issue.

Find the dataset and the four reports: Product Challenges and Market Action Plan, and three intelligent segmentation analysis reports for 'Usage Frequency', 'Tenure', 'Support Calls'.

https://www.capprossbins.cappross.com

Dataset downloaded from Kaggle:

https://www.kaggle.com/code/alihassanshahzad786/customer-churn-prediction/input

FAQ Feature Segmentation

Everything you need to know about CapprossBins and data segmentation modeling

Still Have Questions?

Our team is here to help you get the most out of CapprossBins. Reach out for personalized support, custom implementations, or enterprise solutions.